Online shopping continues to escalate in the home improvement channel. In fact, 70% of online buyers actually prefer to shop online versus in-store, according to The Farnsworth Group 2015 study: “Online Purchasing Behavior for Home improvement Products.”

The study also found that 71% of homeowners purchase home improvement products online and 28% of them do so at least once a month. And because 56% of smartphone owners and 28% of tablet owners use their devices while shopping, marketers need to explore smart ways to capitalize on the growing use of mobile technology at the POP.

Here are some additional highlights:

General U.S. Consumer

- Among online buyers, 50% of smartphone users and 60% of tablet owners use that device to make purchases online

- Top 3 types of sites consumers use for online purchases:

- 65.7% of online buyers are 25-54 years old

Home Improvement Shopper

- 20% of homeowners plan to purchase more HI products online in the future.

- Top 3 things homeowners are looking for when shopping or researching H.I. products online:

- 59% of frequent H.I. product online purchasers are male

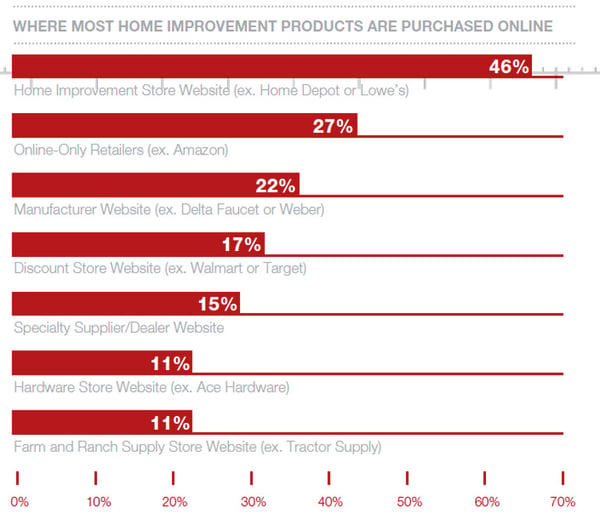

- H.I. stores are the No. 1 destination for online H.I. product shopping. (See graphic below.)

Source: “DIY Online Purchasing Behavior for Home Improvement Products,” The Farnsworth Group, February 2015.

Key Takeaways

Homeowners have fully embraced online technology for information gathering, information sharing and purchasing. Smartphones and tablets have empowered the shopper even further and taken the online experience to a whole other level.

With a more informed consumer who has fingertip access to data, videos and reviews, the role of packaging, displays and advertising must evolve if it is to serve the demanding needs of today’s consumers. HMG is keenly aware of this when working with our clients.

At HMG, we maintain a close eye on consumer shopping habits and then combine that with our extensive in-store and online experience within the H.I. retail channel to develop merchandising and advertising strategies that drive traffic, build trust and maximize market performance.

To learn how we can help you devise progressive merchandising programs that capitalize on the latest trends in online and in-store shopping behavior, contact us today.